Reimagining mortgage distribution

We create powerful software, data and analytics that unites lenders, brokers and aggregators to operate compliantly and efficiently, giving borrowers certainty earlier in their search for a mortgage.

Introducing the Mortgage Brain Hub

The Future of Mortgage Technology!

The Mortgage Brain Hub

We’re excited to unveil the Mortgage Brain Hub – our all-in-one, integrated mortgage technology platform designed to streamline your workflow. Now, all your favourite Mortgage Brain modules are accessible from a single, intuitive web-based interface with just one login. Simplicity at its best!

A closer look at the modules inside Mortgage Brain Hub

- Sourcing Brain – x 10 faster access to products from 100+ lenders with instant valuations and powerful comparison tools

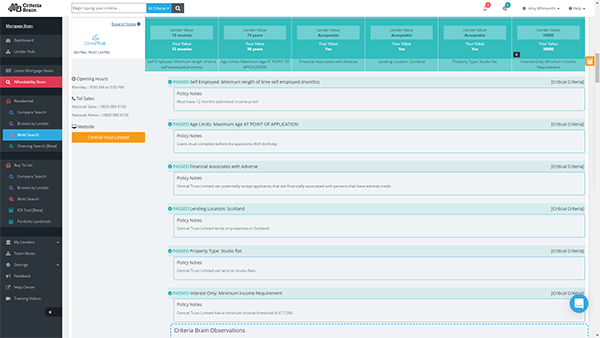

- Criteria Brain – trusted by lenders to power intermediary sites, delivering real-time access to 75,000+ verified criteria and instant comparisons across 90+ lenders

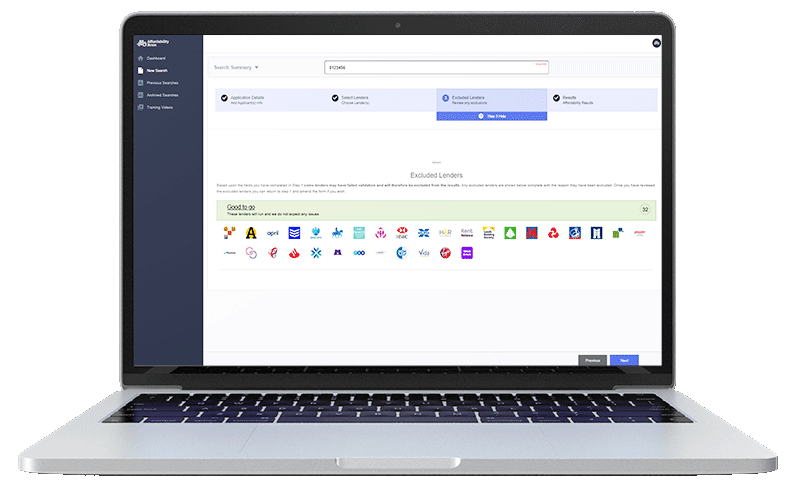

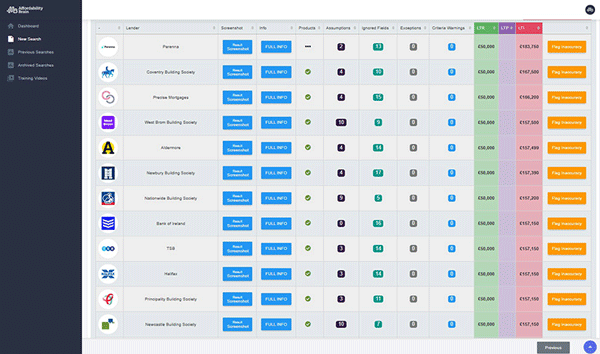

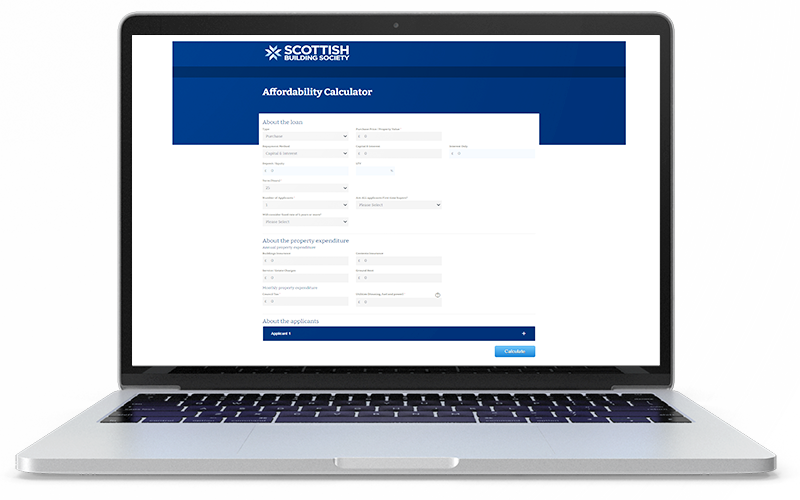

- Affordability Brain – delivers clear results in under a minute from 35+ lenders, with built-in compliance and a full audit trail you can trust.

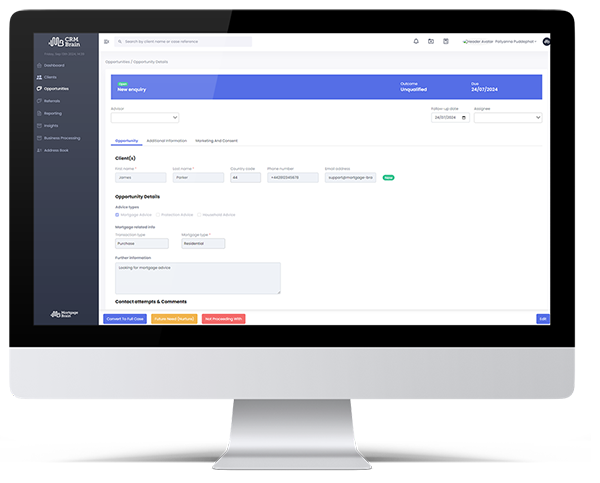

- CRM Brain – helps you manage your team, clients, and leads in one smart system, with seamless data, a secure client portal, and powerful tools to drive growth.

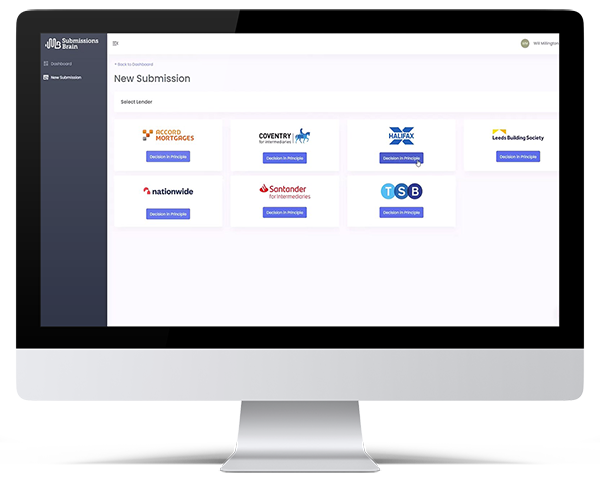

- Submissions Brain – provides one simple, consistent journey for submitting DIPs to multiple lenders, whether integrated with your CRM or used standalone.

Say goodbye to juggling multiple tools and hello to smarter, more efficient mortgage management!

Ready to transform the way you work?

Discover how the Mortgage Brain Hub can take your business to the next level.

Let’s simplify success, together! 🏡✨

Our Integrated Solutions

Explore Mortgage Brain Solutions. Our mortgage broker software offers streamlined solutions for mortgage intermediaries, lenders, and business partners throughout the whole mortgage process.

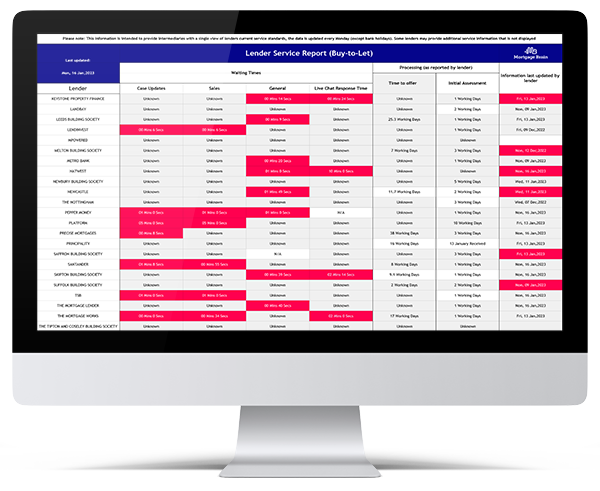

Lender Service Report

Whether you’re a mortgage adviser using our mortgage broker software or a lender, the Lender Service Report is a handy tool that is updated fortnightly. It’s a central point that gives a snapshot of the state of lender service levels across the industry. A quick look tells you the sort of waiting times you can expect for different aspects such as case updates, general response times, initial assessment, and time to offer for both residential and buy-to-let.

For mortgage advisers, it means you quickly make recommendations and set clear expectations without spending time visiting each lender’s website.

For lenders, it’s an easy way to gauge how your service levels are performing against those of your competitors.

Who we are

We’ve been at the forefront of mortgage technology in the UK for over three decades. Backed by some of the largest lenders – Barclays, Lloyds Bank, Nationwide Building Society, NatWest Group, and Santander – we offer a range of mortgage software sourcing solutions, submissions and CRM.