No doubt you spend all your day focusing on your clients and their demands. But there comes a point where you need to consider the health of your business. Do you need to invest? Do you need a cash injection?

It’s a sad fact that many small mortgage brokers are in survival mode right now and small businesses in general are feeling the pressure. The current financial environment means you’re struggling with uncertainty around interest rates and high inflation, rising business rents, a fall in client confidence, and late payments due to the rise in the cost of living.

Poor cash flow is the biggest cause of business failure in the UK with 38% meeting their demise this way[1]. On top of that, 84% of finance brokers say high street banks are increasingly reluctant to lend to SMEs[2]. If that’s the case, what other options do you have? That all paints a gloomy picture, but let’s be positive. Hopefully, you’re in a position where you’re looking to expand your business rather than just counting the pennies. Here are some finance options you could consider.

Funding options

Personal savings

Probably the quickest and easiest way to fund your business is with your own money. It’s flexible, avoids giving away equity in your business, keeps you in control, and best of all, it’s a cheap option. Turning to friends and family could also be a way forward, although this requires a contractual agreement and could strain relationships if things go wrong.

Small business bank accounts with overdraft facility

You probably know how these work – borrow money from a bank or lender and over the years you pay it back with interest. But did you know there are many different varieties that could be tailored to suit your needs and that a small business account gives you access to an adviser, an overdraft facility, and potentially credit card and loan options?

Small Business Administration (SBA) loans

These offer various programmes designed to help small businesses, including those in the financial sector. SBA loans typically have favourable terms and lower interest rates.

Micro-loans, term loans, short-term loans, business loans, and merchant cash advances all come under the umbrella of small business loans, but you could also get loans for specific needs, such as equipment financing, accounts receivable financing, and commercial mortgages.

Bridging loans

As well as property purchases, a bridging loan can be used for other short-term finance purposes, for instance creating a quick boost for your working capital. They can also cover a gap in funding until long-term funding can be secured. They are flexible in terms of interest rates, they can be arranged within 24-48 hours, and it’s possible to borrow larger sums of money as they are secured against an asset.

Bridging loans are a short-term temporary fix and so anyone opting for one should have a definitive exit strategy in place to ensure the loan is repaid in a timely manner. If not, they could find themselves paying high penalty fees or increased interest rates, causing damage to their credit score, or, in the worst-case scenario, the lender could seize any assets used as collateral for the loan.

Business credit cards

Speed and flexibility but with a risk. Use your business credit card when you need it and for almost any business purchase. With a good credit history, a business credit card should be easily attainable – your credit score may dictate your interest rate. The downside however is the higher interest rates, and if your business can’t pay what it owes, you become personally liable.

Business grants

There is one big plus with grants – you don’t have to pay them back. You just need to invest some time in finding the right grant for your business and write a grant proposal. It may be you can receive a lump sum upfront, you could be reimbursed after spending your own money, or you might need to match the grant value before receiving it.

To be eligible for a grant you may need to meet certain criteria that can take into account the size of your business, your location, your business sector, and what the money will be used for. The benefits here are you don’t need to factor in paying the money back and you retain full control of your business.

Remortgage

If you have equity available from your home, you could release that money to use within your business. Business development initiatives can be looked upon positively. Remember, if you choose to remortgage your home and subsequently fail to meet the required payments, there’s a risk that your home could be repossessed. It’s essential to consult with an expert to fully understand the implications and risks involved before making any decisions.

Community Development Finance Institutions (CDFIs)

Although not a bank in the traditional sense, these independent organisations still provide financial services and lending. They do it with a focus on serving communities and putting investments with a positive social outcome first. Here you can benefit from flexible loan amounts that match your specific needs, with that flexibility also applying to the repayment period. You will also find CDFIs often offer competitive low-interest loans.

Line of Credit

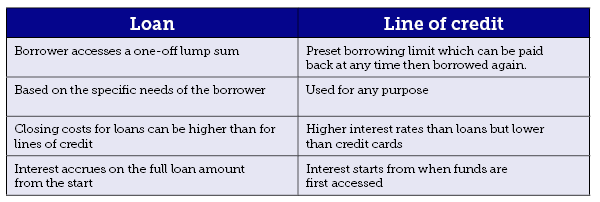

Securing a business line of credit can provide you with flexibility in managing cash flow and covering operational expenses. A line of credit differs from a loan in several ways:

By using a line of credit instead of a credit card you can avoid card transaction fees. If you are having to pay back a large purchase, you can take advantage of paying back over a longer period as opposed to within a month with a credit card.

Alternative finance options

Invoice finance

If you’re having to wait weeks or months to get your invoices paid, this could be a good option for you. Using an invoice finance company will mean they will usually pay you 90% of the value of your invoices as quickly as in 24 hours.

Once an invoice is paid, the invoice finance company will pay you the remaining amount minus their fee. Handy if you’re having cash flow problems but can also be used to bolster other areas of your business where funding is needed.

Crowdfunding

Whether it’s for a business, a private individual, or a charity, crowdfunding means raising smaller amounts of money from many investors rather than a full loan from a single investor.

Platforms like Indiegogo and GoFundMe can be used to raise funds for your business by offering rewards or equity to backers. Crowdfunding is especially effective if you have a unique business concept.

Green finance

If sustainability is a key concern for your business and you are looking to buy electric vehicles or maybe a bank of solar panels, there are lenders in the marketplace who have committed to reaching net zero themselves and will fund you to help you reach that target too.

Whatever reason you have for needing finance there might be more options out there than you think. But of course, there’s no substitute for the advice of a good financial adviser. It is always advisable to seek the advice of a professional financial adviser, one who is experienced in helping small businesses with money management and who will be able to guide you through the process. The Government’s website is a good place to start with a list of 107 schemes available to help established businesses find funding or advice.

Taking care of you

The responsibility that comes with running a business, particularly at a time when cash flow is tricky and finances are under pressure, can take its toll with over half of small business owners experiencing poor mental health over the past 12 months[1]. If you are experiencing stress, anxiety or money worries, there are professional organisations and charities who can help, such as mentalhealthatwork.org.uk who have a whole range of resources to point you in the right direction. Or see: www.mentalhealthatwork.org.uk/support-for-small-businesses-in-partnership-with-simply-business/

If you’re a mortgage broker and feel you can’t cope with the sheer volume of work, read our blog on broker burnout for some ways to find help.

References

- [1] https://www.hwca.com/accountants-london/opinion/why-do-so-many-small-businesses-fail/

- [2] https://bridgingandcommercial.co.uk/article/19546/smes-are-struggling-to-get-funding-from-high-street-banks-reveals-iwoca

- [3] https://www.simplybusiness.co.uk/about-us/press-releases/mind-your-business-launch/