It’s that time of year. People in our industry like to look into the crystal ball to try and predict the size of the market, and trends that will shape how we work, do business, and connect with customers.

But look too far ahead and no one really knows. Things change, and they change quickly. You’ll know that if you saw me presenting at Mortgage Vision or Mortgage Showcase. I call it ‘tomorrow’s world’, predicting possible technological trends over the next year can be hard, but three or five years can be guesswork. There’s a lot of noise out there and it’s hard to know what to believe.

Certainly, it’s important to consider the future, but it’s also good to look at the here and now. To take stock of the changes we’ve made over the past year to the way mortgage brokers do business and the positive impact on their operational efficiencies.

What we know

Last year we were confident we would see greater use of mortgage criteria and mortgage affordability research tools. The latter becoming even more important recently with the downturn in the economy.

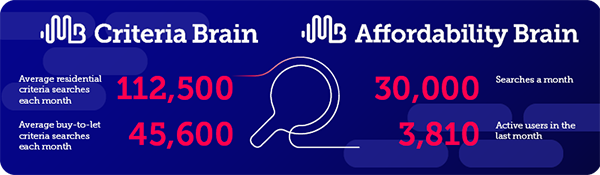

We were right. And one thing I think we can say for the future is that statistics for these platforms will remain on an upward trend thanks to mortgage advisers’ confidence and trust in these solutions and the recognition of their time-saving potential. Searches on Mortgage Brain platforms doubled in the last year. Not from a doubling of our systems in the market, but from repetitive use as brokers appreciate the benefits they bring.

Greater connectivity

The use of application programming interfaces (APIs) is growing rapidly across the industry and Mortgage Brain is one of a small number of fintech companies that are leading the way in harnessing their power. They have the potential to relieve bottlenecks in the mortgage journey, making it easier to find, share and analyse data automatically.

We said last year that more lenders would start to support API integrations, and I believe that we are now closer than ever in reaching what I call ‘critical mass’. By that I mean brokers can do more than 50% of their mortgage business through an API integration without wasting valuable time landing on individual lender sites.

Mortgage brokers can already submit partial or full DIPs directly into a number of lenders’ systems with data from their sourcing solution or CRM. With no rekeying required it’s an instant time-saver. With the number of lenders, already on board, looking ahead into 2023 it should be possible that a broker can do 70% of their business straight from their own system, directly into the lenders’ systems via an integration.

A prime example of this is our recent work with mortgage and protection platform Acre. Our API development has enabled Acre’s broker network to connect directly to Santander’s systems to get full DIPs at the click of a button with results returned within 30 seconds.

Integration is an important part of our sourcing solutions too. The integration of Sourcing Brain with Criteria Brain and Affordability Brain offers a complete view of the market, helping to find the perfect product in a single journey. With Hometrack AVM included free, a broker can have more confidence the property valuation is accurate, and the submission is more likely to be successful.

This isn’t tomorrow’s world. This is now.

For the future

If you twist my arm to look forward and give you one factor that could begin to play an important role in the mortgage sector next year, I will say open banking.

The move of its use from banking to the mortgage industry is a natural progression. Quicker applications and onboarding will be possible thanks to fast, accurate data transfer and analysis.

Open banking can be used to verify income, provide quicker identity confirmation, and improve the customer experience, whilst moving away from the manual processes that have led to slow, inefficient, and expensive customer journeys.

The more standard and low-risk cases can be automated, leaving brokers to focus more on the ever-increasing number of complex cases. And with more data available through open banking, lenders will be able to use data already secured for a lending decision to offer other services the home buyer may need such as credit services, financial planning, and insurance.

Open banking is on the rise, and quickly. To put this into perspective:

- Open banking transactions March 20 to October 20 – 6.1m

- Open banking transactions March 21 to October 21 – Over 20m

I see this continuing to develop and grow next year.

Looking ahead, there’s one thing I know for sure. Next year will be an exciting one for Mortgage Brain, and for mortgage brokers too. Watch this space.

Why not find out more about Mortgage Brain’s time-saving solutions for UK mortgage brokers and take a free trial?