Mortgage Brain’s collaboration with Leeds Building Society added a fully customised Criteria Brain integration to the lender’s intermediary website. Using Mortgage Brain’s market-leading technology enhances the search process for its intermediaries and benefits the lender too.

The problem

Leeds Building Society was looking for a way to simplify the sourcing process for its intermediaries to give them greater efficiencies, and ultimately a better experience for their customers. They also needed a way to ensure that the information intermediaries were using was the most up-to-date it could be. They wanted technology that would solve this problem.

The solution

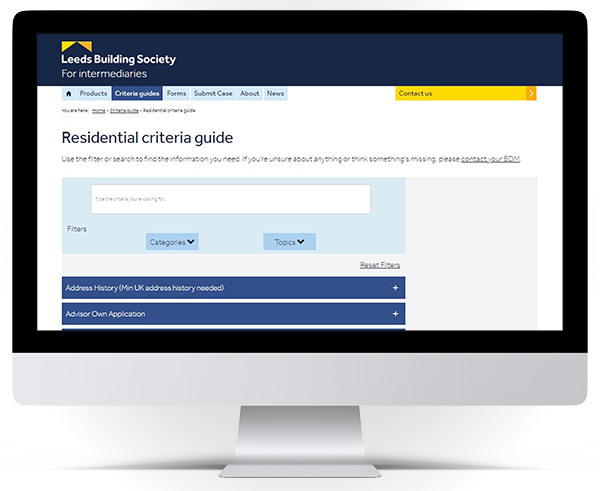

Mortgage Brain developed a customised i-frame to power Leeds Building Society’s criteria policy pages on their intermediary website. This had the added benefit of the lender being able to update policy information from one entry point which then replicates across both their own website and Criteria Brain.

Key benefits of this solution included:

- Automatic updates meaning that criteria information will always be current on the website and for Mortgage Brain users

- Lender inputs data through one point of entry, meaning no inefficient rekeying of information

- Saves brokers precious time and reduces the amount of pre-application policy calls to the lender

- Provides brokers with peace of mind that the information they seek is the most up-to-date

- Significant reduction in administrative workload for both broker and lender

The result

Leeds Building Society’s criteria pages now give mortgage brokers access to comprehensive and up-to-date criteria information on residential and buy-to-let mortgage ranges with the peace of mind that brings.

The lender benefits too from essential time savings on updating policy information with the eradication of rekeying. Mortgage Brain users see the benefits here too with sourcing solution automatically updated with lender updates.

Neil Wyatt, Sales and Marketing Director, Mortgage Brain

James O’Reilly, Head of Intermediary Partnerships, Leeds Building Society

About Leeds Building Society

Leeds Building Society was established in 1875 with the core purpose of helping people to save money and own their own homes. Their first year saw 450 accounts opened with lending totalling £16,000. By 2012, that had grown to £10bn. They are a mutual society, owned by and run entirely in the interests of its members. Leeds Building Society’s criteria policies cover a wide range of categories including Limited Company Buy-to-Let and their new Reach mortgage product range.