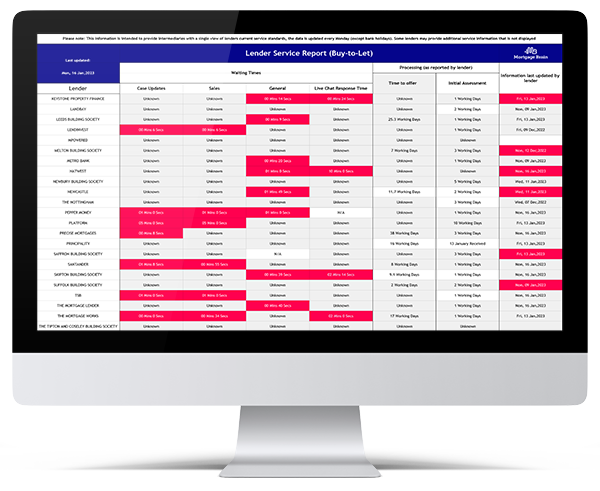

Lender Service Report

Whether you’re a mortgage adviser or a lender, the Lender Service Report is a handy tool that is updated fortnightly.

It’s a central point that gives a snapshot of the state of lender service levels across the industry.

Find out which lenders are performing well recently with their response times and processing times below:

Who is the mortgage lender service report for?

Mortgage advisers

For mortgage advisers, the lender service report allows you to it means you quickly make recommendations and set clear expectations without spending time visiting each lender’s website.

It also allows advisors to set realistic expectations for clients regarding processing wait times and approval rates, which can improve client communications and satisfaction.

Knowing the level of service to expect from lenders can also help to build broker-lender relationships. Find out why this is important in our article ‘Why the key to client happiness is a successful broker-lender relationship.’

Mortgage lenders

For lenders, the report is it’s an easy way to gauge how your service levels perform against those of your competitors.

We advise that you use the report to determine which processes need their strategy adjusted to improve service delivery. Our article, ‘Technology can be used to give customers what they want’ explains how technology can be used to optimise processes.

Our dedicated pages also contain our lender-specific technology, such as Distribution Brain, Insights Brain, and Services Brain.

FAQs

What is the lender service report?

A report published every two weeks that provides updated statistics on mortgage lender services. This report helps measure key industry performance indicators (KPIs) such as a lender’s performance, service levels, and mortgage management.

How reliable is the data?

The data is supplied directly from the lenders themselves. We collate the data from a large number of lenders’ websites to give you a comprehensive comparison of lender service standards.

How to use this data?

Intermediaries often use these reports to assess which lenders are the best to work with based on their performance, speed, and customer service.

How long does it take to get a mortgage?

Many factors influence how long it takes to get a mortgage, such as your financial situation, the type of mortgage you’re applying for, and the lender’s processes. If you need to get a mortgage quickly, it’s advisable to choose a lender known for fast processing and to have all your documents ready to avoid delays.