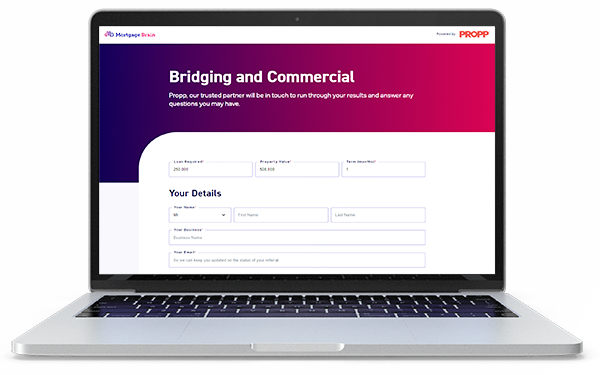

Refer to Propp, the specialist property finance experts

Our strategic partnership with Propp, the UK’s first comparison site for specialist property finance, will enable you to generate income from clients with specialist needs. Propp are experts in bridging, commercial, development finance, complex BTL and secured loans.

Specialist property finance advice

from Propp

Identified a client that needs specialist advice? Hand the reigns to an expert at Propp. Simply refer, and earn 30% of the procuration fee for every completion.

Benefits to mortgage advisers referring clients to Propp

Free up time

Spend more time on the cases that generate you income and leave the specialist advice to the specialists

Transparency

You’ll be updated at every stage in the case, whether it progresses or not.

Expertise

Specialist finance is Propp’s bread and butter. Your clients are in good hands

Additional income

Earn 30% of the procuration fee for every completion

Dramatic rise in demand for bridging and commercial loans

Data from Propp reveals that since April 2022 queries for bridging products have increased by an incredible 156% with requests for commercial products rising by 140%.

Nationally, bridging lending is growing in popularity, particularly with homebuyers who have experienced a breakdown in their property purchase chain following recent housing market turbulence.

It has also become a tool widely used by landlords and investors who, being squeezed by tighter buy-to-let margins, are turning to auctions to pick up a bargain.

The commercial market is on the up after being hit first by the pandemic, and then again by rate increases and instability following the mini-budget.

Finally, lenders are returning to the market with an appetite to lend, so it’s a great time for brokers to capitalise on pent-up demand for commercial refinance.

With current demand on the increase, this could be an ideal time for mortgage brokers to explore new opportunities in unregulated lending.

Got a question?