Ask a customer how much their house is worth, and the chances are, their valuation is inaccurate.

Research shows that 80% of homeowners are unsure about the true value of their homes.

Inaccurate property valuations can create problems for lenders and borrowers, leading to longer sales processes and financial mismatches.

Hometrack is the UK’s leading automated valuation model (AVM) and our proud partners for delivering accurate property valuations.

This article will explain why we use Hometrack’s AVM to provide brokers with more accurate and dependable property valuations.

What is an automated valuation model?

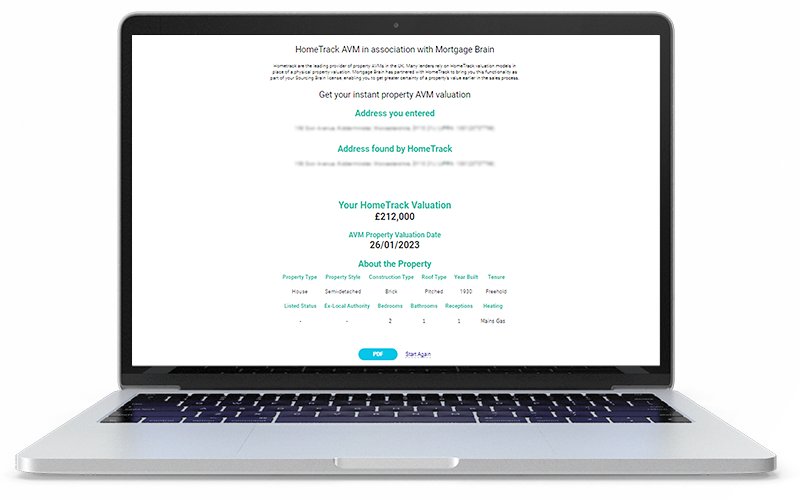

An automated valuation model (AVM) is a technology-driven tool for estimating a property’s value. They often appear online after searching for ‘How much is my house worth?’.

These tools are easy to access and provide instant property valuations.

Why do we provide Hometrack AVM integration at no extra cost?

We offer Hometrack AVM reports at no extra cost to Sourcing Brain users because mortgage brokers must get property valuations right the first time.

Having a clear property value early in the mortgage process significantly boosts the chances of success when reaching the application stage.

Hometrack AVM instant valuations are known for their accuracy. They employ advanced technology, extensive data, and a thorough understanding of the real estate market to deliver reliable valuations.

About Hometrack

Hometrack is the leading provider of Automated Valuation Models (AVMs) in the UK. It offers instant and accurate property valuations, which lenders have relied on since 2002.

Today, over 80% of the top lenders in the UK use Hometrack to conduct around 50 million valuations each year.

Founded in 1999, Hometrack gained prominence with its AVM technology. In addition to valuations, the company provides data solutions tailored for property investors, landlords, housebuilders, and housing associations. Hometrack is also a founding member of the European AVM Alliance.

The problem with property valuations

Inaccurate property valuations can lead to an application being rejected, with the lender disputing the value of the property. The application would then need to be resubmitted, and the mortgage journey would be delayed.

In fact, one in five mortgage applications fail at the lender valuation stage.

Find out why more than 1 in 5 mortgage applications fall at the lender valuation hurdle in our article ‘Taking the guesswork out of home valuation’.

The solution for an accurate online property valuation

Mortgage Brain spotted the opportunity to partner with Hometrack and include its property valuation functionality within Sourcing Brain as a free integration.

This means that when sourcing a mortgage for a customer, a broker can get a valuation on the property in an instant and be confident that it’s correct without second-guessing.

The result of using a reliable property valuation tool

The result is faster, more efficient mortgage applications and a better customer experience.

The process is more streamlined, with quicker and more positive decisions, and there is more pre-valuation confidence for the mortgage broker, irrespective of the lender.

Borrowers want reassurance, transparency, simplicity, and speed.

Our article ‘Using technology to give customers what they want’ explains more about how our technology can provide this.

How else can brokers use Sourcing Brain?

Alongside giving customers a more accurate idea of their mortgage costs, sourcing brain can be used to:

- Explore new financial products and penetrate untapped markets

- Simplify the comparison of multiple products

- Save time with search filters

If you’re an FCA-registered broker, you can book a free Sourcing Brain live demo online or try Sourcing Brain out for 30 days to discover first-hand what it offers.

Find out more about Mortgage Brain products

Neil Wyatt, Sales and Marketing Director, Mortgage Brain

“We’re excited to partner with Hometrack to deliver this latest enhancement to our Sourcing Brain users at no additional cost. The speed and simplicity of Sourcing Brain coupled with the accuracy of valuations through Hometrack’s Broker AVM gives advisers a better chance of finding the perfect product first time around. As the No. 1 mortgage technology providers, Mortgage Brain are focused on making broker processes quicker and more efficient, to ensure a more streamlined journey for their customers.”

George Robbins, VP Commercial, Hometrack

“Brokers are a critical touchpoint in the mortgage application process for consumers, and embedding Broker AVM in Sourcing Brain as standard will help to ensure Hometrack’s market-leading expertise is made available to them - increasing accuracy and driving efficiency across the board. “The partnership also supports our strategy to enable mortgages to be delivered in minutes, realising our vision for a digitised mortgage journey for each of the core stakeholders: lenders, brokers, and consumers. “This is just the start of a partnership built on innovation, and we look forward to growing together and delivering additive value in the future.”